Some consider gold and other precious metals to be unproductive investments compared to stocks. According to Graham Summers, Chief Market Strategist at Phoenix Capital Research, these “experts” are conveniently ignoring some significant facts…

Measuring profits of precious metals vs. stocks

Gold and other precious metals are classified as “commodities”, in which the owner of that metal possesses a physical, distinct object. Stocks, on the other hand, are classified as “equities”, in which the stockholder owns a part of the company that has issued the stock.

Precious metal investors make money when the demand for the metal they hold increases. Stockholders, however, make money when the company that they have purchased stock in increases profits or improves business standing. This results in a increased demand to own a part of that company, and therefore the price of the stock increases.

Before 1967?

According to Summers, it is impossible to compare gold’s performance in relation to stock at anytime before 1967. Up until this date, gold was pegged to currency, which limited gold’s potential for growth.

After 1967?

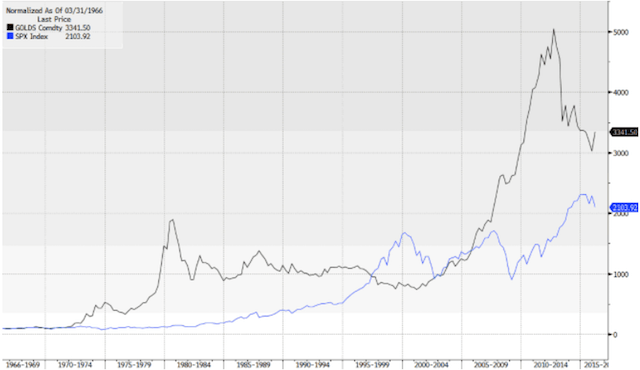

When gold began to be de-pegged from currency after 1967, however, the story changes dramatically. Bill King, a Wall Street trading veteran, says that “gold’s performance has absolutely demolished that of stocks post 1967”.

Even though gold lost nearly 40% of its value since 2011, while at the same time stocks are reaching record highs over 2,100 on the S&P 500, there is still no comparison, as illustrated by the chart below.

Gold’s high performance has continued despite the high interest by the federal government in “propping stocks up by printing money or maintaining interest rates far below where they should be”, according to Summers. Not to mention that between 2000 and today there have been two of the largest stock bubbles in history.

Graham Summers: case for gold compared to stocks

Despite gold’s high performance, it is still rarely promoted in the media, and represents an asset class that less than 1% of investors actually own. Why is this?

- Gold doesn’t generate revenue for financial institutions such as brokers, investment managers, etc.

- Gold doesn’t benefit the banks as owners can hold the gold in their own safes.

- Gold and its performance runs counterpoint to the view that you can generate wealth by printing money.

- And in sum, buying gold represents taking money out of the financial system—something that the federal government has no interest in.

Despite these reasons, Graham Summers still feels that gold will only continue to outperform stocks, and is currently showing a trend of turning upwards against all major currencies.