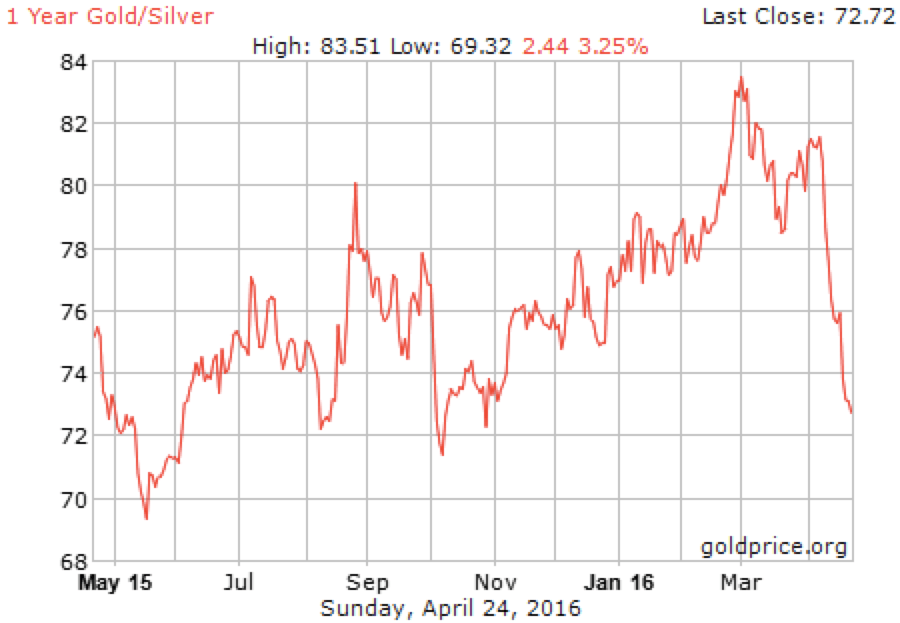

Silver is having a good few weeks…

Scratch that, a good year…

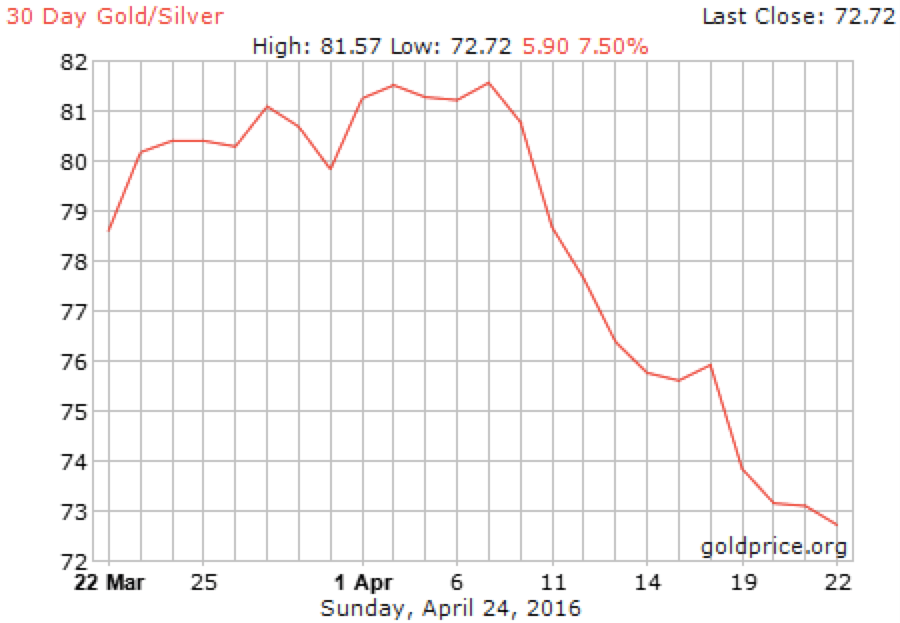

In fact, in the past three weeks, the white metal has seen it’s largest advance in more than a year—13% since April 1.

A record-breaking price rally

The gold to silver ratio hovers at just above 72 (as of April 25, 2016), indicating that at current rates a single ounce of gold, with future prices of $1,235 USD is worth 72 ounces of silver, priced at $17 USD. The price is up over 20% since the beginning of January 2016 and is at the highest levels since this time last year. Furthermore, silver prices have rose higher than any other metal this year.

An indicator of industrial growth?

The explanations behind this leap are mixed but some analysts believe that a rise in silver prices may be a good indicator in a turnaround of the global economy, due to silvers extensive industrial uses, especially in comparison to gold. According to Frank Holmes, CEO of U.S. Global Investors in an interview with Kitco news:

“Silver has overtaken gold as the years best performing precious metal, extending its gains to 17 percent on the back of a stabilizing Chinese economy. The precious metal, which is used in a variety of industrial products, is now trading at a five-month high”.

And while silver may not be as scarce as gold, it is becoming increasingly attractive for investors, especially for its industrial purposes and in emerging markets. In actuality, global annual silver demand is comprised of half industrial use.

Touched on in a previous article, silver is used in many modern technologies— from medical purposes to electronics to the automotive industry— and emerging green technologies such as photovoltaic or water purification also utilize this white metal.

Solar energy, in particular, is a big driver of silver demand. On solar panel is typically connected via 6 x 10 solar panels. Each solar cell requires two thirds of an ounce of silver. Depending on the vastness of the photovoltaic system, this can be a significant amount of silver. Today, solar energy accounts for more than 13% of total industry demand, an increase of nearly 12% since ten years ago.

Can this price rally be maintained?

In contrast to being an indicator of future economic growth, some analysts believe that silver prices are merely catching up to the gold rally earlier this year. Others believe that the ratio still has more room to fall in the direction of more historical averages (roughly 40).

In a recently published research report Deutsche Bank AG analyst Grant Sporre writes “We think momentum could carry silver” and that “(silver) tends to be a late-cycle play in precious metals”. Furthermore, Deutsche Bank analysts even conclude that silver may be reaching $20 USD per ounce in the near term.