As market factors such as economic uncertainty, inflation and debt are on the rise, investing in gold and silver is an attractive option. Because of the gold silver ratio many experts believe that at current rates “undervalued” silver may soon outperform gold.

What is the gold silver ratio?

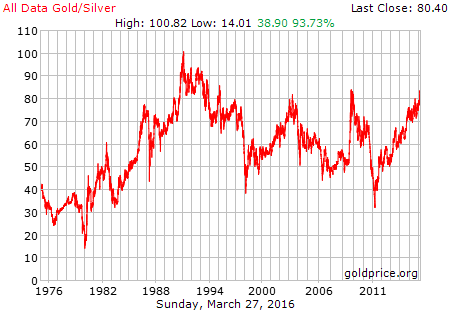

The ratio of gold to silver can serve as a signal to investors of gold, silver and other precious metals of when is the right time to buy or sell a particular metal. Generally, when the ratio is high, silver is favored. On the other hand, when the ratio is low, gold is favored.

Currently, the ratio of gold to silver is roughly two and a half times higher than it was 5 years ago (1 to 35), and more than 5 times greater than historical averages (1 to 16). As of March 27th, 2016, the ratio was sitting at about 1 to 80. This indicates that a single ounce of gold, with future prices of $1,214 USD is worth 80 ounces of silver, priced at $15.17.

What does the gold to silver ratio really mean?

When the ratio is high, silver is considered “undervalued” relative to gold (and vice versa for gold at a low ratio). Purchasing silver at current rates, with the possibility that the ratio will return to previous values may be a good option for investors following the logic that selling one metal when it is overpriced and investing the proceeds in an underpriced one will increase net ounce position without investing additional funds.

However, although investing in non-consumables, such as gold, silver or other precious metals is relatively safe compared to other speculative markets, it may be difficult for novice or small-scale investors to read the signals and make a profit because the gold-to-silver ratio fluctuates so frequently.

Gold-to-silver ratio in today’s economy

Gold has increased steadily over the past five years. When the global economy is relatively weak and inflationary, coupled with declining real interest rates, gold usually serves to gain the most over silver. This may explain why the ratio has been on the rise.

However, if many of the economies that were facing recession in the past few years begin to recover, this may benefit silver more than gold, causing the gold-to-silver ratio to contract.

And while silver may be undervalued in compared to gold, some experts suggest that instead of selling gold, investors may look to cut their allocations to stocks, bonds and property and instead invest in silver.

Support for Silver

Silver’s role as an industrial metal is one of its most attractive selling points, and may be more advantageous than its role at a precious metal. It was traditionally used in photographic development, but that role has been slowly declining since 2000. Today, silver is commonly used in electronic appliances (it has the lowest resistivity of industrial metals), photovoltaics (it is one of the highest reflectors of light) and for certain medical uses (silver has antibacterial properties). New products for industrial, commercial and consumer uses are being introduced almost daily that utilize silver.

According to some experts, silver’s industrial uses may serve as an indicator that the gold-to-silver ratio will gradually return to the average over the past century, which is roughly 1 to 40.